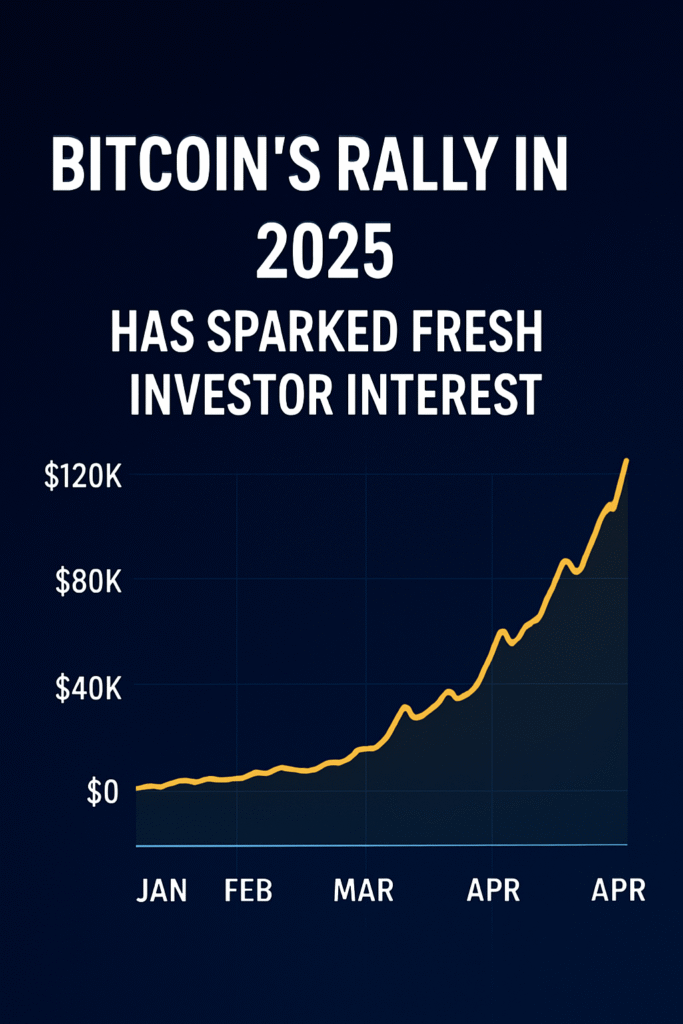

Bitcoin is back in the spotlight. After a quiet period in early 2025, the world’s most popular cryptocurrency is once again making headlines—this time for climbing toward the $120,000 mark. Investors, traders, and even everyday savers are asking the same question: Is Bitcoin entering a new golden phase?

🚀 Why Bitcoin Is Rising

- Institutional Demand: Big financial firms and ETFs are pouring money into Bitcoin.

- Global Uncertainty: Economic shifts and inflation fears are pushing people toward digital assets.

- Scarcity Factor: With only 21 million coins ever to exist, demand keeps outpacing supply.

📊 Bitcoin in Daily Life

Bitcoin is no longer just a speculative asset. In the U.S. and beyond:

- Major retailers now accept crypto payments.

- Cross-border transactions are faster and cheaper with Bitcoin.

- More states are exploring crypto-friendly regulations.

⚠️ Risks You Shouldn’t Ignore

Like any investment, Bitcoin comes with risks:

- Price Volatility – Sudden swings can wipe out gains overnight.

- Regulatory Uncertainty – Governments are still figuring out crypto rules.

- Scams & Security – Hackers target careless investors.

🔮 What’s Next for Bitcoin?

Experts are divided:

- Some believe Bitcoin could hit $150,000+ by the end of 2025.

- Others warn of corrections once speculative hype cools down.

- One thing is certain: Bitcoin is here to stay, and it’s shaping the future of money.

✨ Final Thought

Bitcoin is no longer just a buzzword—it’s a movement. Whether you’re an investor, a tech enthusiast, or just curious, now is the time to watch how this digital asset transforms finance in 2025 and beyond.